Law360 (October 14, 2021, 6:29 PM EDT) — Johnson & Johnson said Thursday that it has sought Chapter 11 protection in North Carolina bankruptcy court for LTL Management, the subsidiary it has newly spun off to hold its cosmetic talc liability.

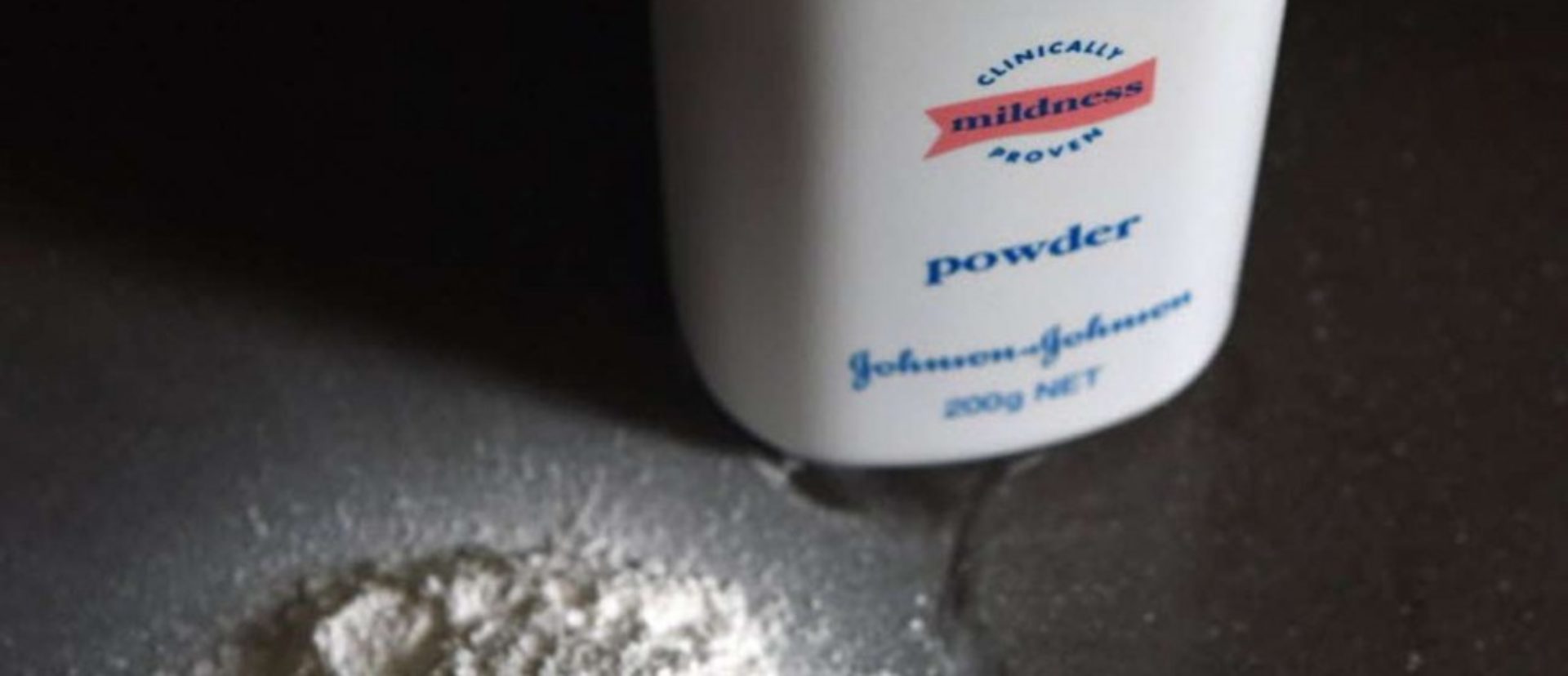

J&J said Thursday that it was seeking Chapter 11 protection for the newly spun off subsidiary holding its talc liability. (AP Photo/Mel Evans)

“We are taking these actions to bring certainty to all parties involved in the cosmetic talc cases,” J&J general counsel Michael Ullmann said in the statement.

In the announcement, J&J said it has committed to providing LTL with funds to pay amounts the bankruptcy court determines the company owes. It said it will establish a $2 billion trust to pay claims against LTL and has allocated spinoff royalty revenue streams worth more than $350 million to contribute to potential costs.

“With the financial backing of Johnson & Johnson, coupled with a dedicated trust and significant financial resources supporting LTL, we are confident all parties will be treated equitably during this process,” LTL Chief Legal Officer John Kim said in the statement.

LTL’s Chapter 11 petition puts both its assets and liabilities between $1 billion and $10 billion.

In its announcement, J&J said the filing was not an admission of liability, saying it has won the majority of talc-related jury trials and continues to believe the claims are meritless.

For months, media reports had speculated J&J was preparing to make this move, which is called the “Texas two-step” by plaintiffs attorneys because of a feature of that state’s law that can make shedding liabilities via spinoff relatively easy. Mainly it allows a “divisive merger” in which a company rends itself in two and allocates assets and liabilities between the two parts however it prefers.

In July, a House of Representatives subcommittee asked J&J to turn over information about its plans to put its talc liabilities under bankruptcy protection, and judges in Delaware bankruptcy court and New Jersey state court have denied motions by talc plaintiffs seeking to prevent J&J from making such a move.

Tens of thousands of injury claims have been leveled against J&J and its longtime supplier Imerys Talc America in recent years. Those claims arise from diagnoses of mesothelioma and ovarian cancer that were allegedly caused by long-term exposure to talc products containing asbestos.

Imerys and two affiliates filed for Chapter 11 protection in February 2019 under the financial strain of defending against the talc injury suits.

In an email statement late Thursday from Beasley Allen Crow Methvin Portis & Miles PC, a firm representing talc claimants, attorney Andy Birchfield said the development “stinks.”

“The entire nation, Congress and more than 30,000 victims of J&J’s dangerous talc product say ‘no’ to this flagrant and fraudulent abuse of the bankruptcy system,” he said. “Right behind the Sacklers, the Boy Scouts and USA Gymnastics, here’s another example of the wealthy and powerful using bankruptcy as a hiding place to protect their profits and avoid responsibility.”

LTL is represented by Gregory M. Gordon, Dan B. Prieto, Amanda Rush, Brad B. Erens and Caitlin K. Cahow of Jones Day, C. Richard Rayburn, Jr. and John R. Miller, Jr. of Rayburn Cooper & Durham PA, Kristen R. Fournier of King & Spalding LLP and Kathleen A. Frazier of Shook Hardy & Bacon LLP.

The case is In re: LTL Management LLC, case number 21-30589 in the U.S. Bankruptcy Court for the Western District of North Carolina.

–Additional reporting by Vince Sullivan. Editing by Alanna Weissman.